Are you tired of feeling like your moneyis disappearing into a black hole? Do you find yourself struggling to make ends meet at the end of the month, despite your best efforts? If so, it's time to try a different approach: zero-based budgeting!

Now, I know what you're thinking. "Zero-based budgeting? That sounds like something only accountants and financial experts would enjoy." But trust me, zero-based budgeting can be fun (yes, really!) and it can help you take control of your finances in a way that feels empowering, not restrictive.

So, grab your calculator, and let's dive into the world of zero-based budgeting. Who knows, you might just discover your inner financial guru along the way!

What Is Zero-Based Budgeting?

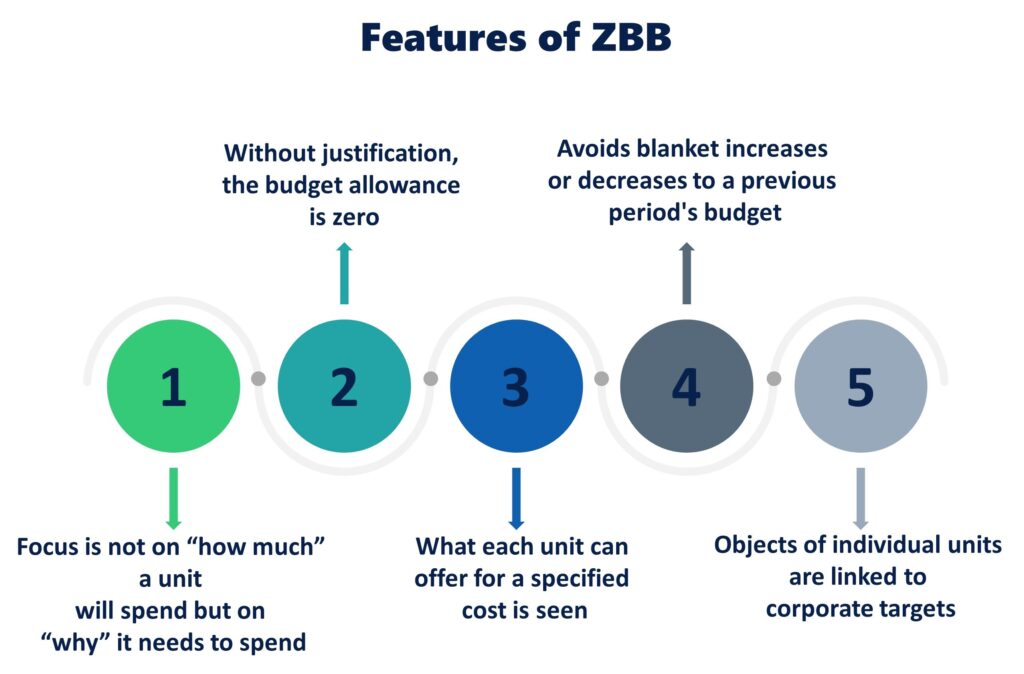

Zero-based budgeting is a financial planning process that requires a company or an individual to start their budget from scratch every time. Instead of simply taking the previous period's budget as the starting point, zero-based budgeting requires you to justify every expense and allocate resources according to the organization's goals and objectives. In other words, every expense must be justified and prioritized before being included in the budget.

Why Is Zero-Based Budgeting Important?

Zero-based budgeting is an essential tool for companies and individuals who are looking to optimize their spending and achieve their financial goals. Here are some reasons why zero-based budgeting is important:

It Helps To Eliminate Waste

By starting from scratch and justifying every expense, zero-based budgeting can help organizations identify and eliminate wasteful spending. This can help companies save money, improve their financial performance, and increase profitability.

It Provides A Better Understanding Of Costs

Zero-based budgeting requires a detailed understanding of every expense and its associated costs. By taking this approach, organizations can gain a better understanding of their costs, including fixed costs and variable costs, and make more informed decisions about how toallocate resources.

It Promotes Strategic Thinking

Zero-based budgeting forces organizations to think strategically about their goals and objectives. By aligning every expense with the company's goals and objectives, organizations can ensure that their spending is aligned with their overall strategy.

It Can Help Identify New Opportunities

Zero-based budgeting can help organizations identify new opportunities for growth and improvement. By taking a fresh look at every expense, companies can identify areas where they can invest more resources to achieve better results.

Zero-Based Budgeting Example

To illustrate how zero-based budgeting works in practice, let's take an example of a company that wants to implement this approach. The company is a small manufacturing company that produces furniture. The company's goal is to increase profitability while maintaining a high level of quality. Here are the steps the company would take to create a zero-based budget:

- Start with a blank slate- The company would start by assuming that they have zero dollars to spend. Every expense would have to be justified and prioritized.

- Identify and prioritize expenses - The company would then identify all of the expenses that are required to run the business, including rent, salaries, utilities, and raw materials. The company would then prioritize these expenses based on their importance and relevance to the company's goals and objectives.

- Determine costs- The company would then determine the costs associated with each expense, including fixed costs and variable costs.

- Allocate resources - Based on the company's goals and objectives, the company would then allocate resources to each expense, starting with the most important expenses first.

- Review and adjust- Finally, the company would review and adjust the budget as necessary to ensure that it aligns with its goals and objectives.

How To Create A Zero-Based Budget

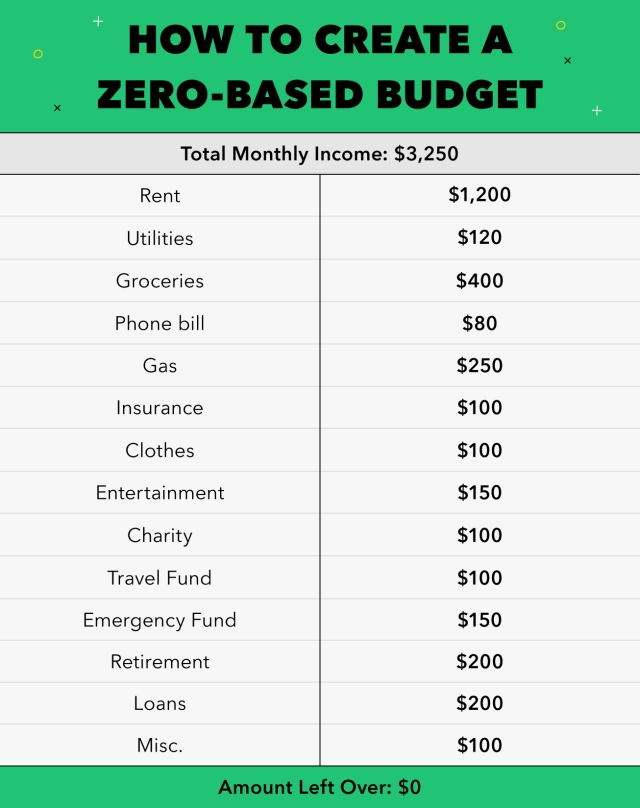

Creating a zero-based budget can be a time-consuming process, but it can also be very effective in optimizing spending and achieving financial goals. Here are the steps to create a zero-based budget:

Step 1 - Start With A Blank Slate

The first step in creating a zero-based budget is to assume that you have zero dollars to spend. This means that every expense must be justified and prioritized based on its importance and relevance to your financial goals.

Step 2 - Identify And Prioritize Expenses

The next step is to identify all of the expenses that are required to achieve your financial goals. This includes both fixed expenses (such as rent or mortgage payments) and variable expenses (such as groceries or entertainment expenses). Once you have identified all of your expenses, prioritize them based on their importance to your financial goals.

Step 3 - Determine Costs

The third step is to determine the costs associated with each expense. This includes fixed costs that remain constant regardless of changes in activity levels, and variable costs that change as the level of activity changes. For example, fixed costs might include rent or insurance premiums, while variable costs might include supplies or labor costs.

Step 4 - Allocate Resources

After identifying and prioritizing expenses and determining their costs, the next step is to allocate resources based on your financial goals. This means allocating funds to the most important expenses first, and then allocating funds to lower-priority expenses as needed.

Step 5 - Review And Adjust

The final step is to review and adjust your budget as necessary to ensure that it aligns with your financial goals. This means reviewing your budget regularly to ensure that you are on track to achieve your financial goals, and making adjustments as needed to stay on track.

The Pros And Cons Of Zero-Based Budgeting

Like any financial planning approach, zero-based budgeting has its pros and cons. Here are some of the advantages and disadvantages of zero-based budgeting:

Pros

It Helps To Identify Wasteful Spending

Zero-based budgeting can help organizations identify wasteful spending and eliminate it, which can lead to significant cost savings.

It Encourages Strategic Thinking

Zero-based budgeting forces organizations to think strategically about their goals and objectives, which can help them make better decisions about how to allocate resources.

It Can Help Identify New Opportunities

Zero-based budgeting can help organizations identify new opportunities for growth and improvement, by taking a fresh look at every expense.

Cons

It Can Be Time-Consuming

Zero-based budgeting can be a time-consuming process, as every expense must be justified and prioritized. This can be a significant burden on organizations with limited resources.

It Can Be Complex

Zero-based budgeting can be complex, as it requires a detailed understanding of every expense and its associated costs. This can be challenging for organizations that lack financial expertise.

It Can Lead To Short-Term Thinking

Zero-based budgeting can lead to short-term thinking, as organizations focus on immediate cost savings rather than long-term investments. This can be problematic for companies that need to invest in research and development or other long-term initiatives.

People Also Ask

How Does Zero-based Budgeting Differ From Traditional Budgeting?

Zero-based budgeting differs from traditional budgeting in that it requires every expense to be justified and prioritized from scratch, rather than simply adjusting the previous period's budget. Traditional budgeting usually assumes that expenses will remain constant unless there is a specific reason to change them, while zero-based budgeting assumes that every expense must be justified in relation to the organization's goals and objectives.

Is Zero-based Budgeting Only Useful For Businesses, Or Can Individuals Use It Too?

While zero-based budgeting is often associated with businessbudgeting, individuals can use it too. In fact, zero-based budgeting can be a great tool for individuals who want to take control of their finances and optimize their spending. By starting from scratch and justifying every expense, individuals can identify and eliminate wasteful spending, gain a better understanding of their costs, and make more informed decisions about how to allocate resources.

What Are Some Common Mistakes To Avoid When Implementing Zero-based Budgeting?

One common mistake to avoid when implementing zero-based budgeting is failing to involve all relevant stakeholders in the process. It's important to get input from everyone who will be affected by the budget, including managers, employees, and customers. Another mistake is underestimating the time and effort required to implement zero-based budgeting effectively. It can be a time-consuming and complex process, but the benefits can be significant if it's done right.

How Can Technology Be Used To Support Zero-based Budgeting?

Technology can be a powerful tool to support zero-based budgeting. For example, budgeting software can help organizations track expenses and monitor progress toward their goals in real-time. Data analytics tools can also help organizations identify patterns and trends in their spending, which can inform future budget decisions. Finally, collaboration tools can help teams work together more effectively to create and manage budgets.

What Are Some Alternatives To Zero-based Budgeting?

There are several alternatives to zero-based budgeting, including incremental budgeting, activity-based budgeting, and performance-based budgeting. Incremental budgeting is a traditional budgeting approach that assumes expenses will remain constant unless there is a specific reason to change them. Activity-based budgeting is a method that links expenses to specific activities or tasks, and performance-based budgeting focuses on outcomes and results rather than inputs and expenses. Each of these approaches has its own strengths and weaknesses, and organizations should choose the approach that best aligns with their goals and objectives.

Conclusion

Zero-based budgeting is a powerful financial planning approach that can help organizations optimize their spending and achieve their financial goals. By starting from scratch and justifying every expense, organizations can identify and eliminate wasteful spending, gain a better understanding of their costs, and make more informed decisions about how to allocate resources.

While zero-based budgeting can be time-consuming and complex, its benefits can far outweigh its drawbacks for those willing to invest the time and effort required to implement it effectively.